uber eats tax calculator canada

Your tax summary is an Uber-generated tax document. It provides a detailed breakdown of your annual earnings and business-related expenses that may be deductible.

Doordash Taxes Does Doordash Take Out Taxes How They Work

This is because VAT is.

. Hi where can I input Uber Eats Tax Summary items such as On TripMileage when use BIKE no motor vehicle was used Gross Uber Eats fare Tips Incentives and. Uber Eats Pay Rate. My tax summary shows gross uber rides fares gross eats fares split fare.

For up follow questions t. Same pizza same toppings. The Canada Revenue Agency CRA requires that you file income tax each year.

Understanding your 1099 forms Doordash Uber Eats Grubhub. Driving Delivering - Uber Help. The first one is income taxes both on federal and state levels.

Using our Uber driver tax calculator is easy. According to my Uber Tax Summary I earned 26300 driving with Uber Eats in 2019. Watch this 40-min on-demand TurboTax workshop to understand how to properly report your Uber Partner income and expenses.

I printed my Uber Tax Summary and it shows the following. When you were calculating your uber fees the 10000 amount which line items did you use. The rate is 72 cents.

Gross uber rides far 42054 Tolls 571 Booking fee 5750 Total income of 48375 ReferralIncentives 35565. Please try again later. The Canada Revenue Agency CRA is responsible for collecting remitting and filing sales tax on all of your ridesharing trips.

Uber Eats Canada Food Delivery and Takeout Order Online from. People aged 19 years old and over in Toronto can order. The Canada Revenue Agency CRA is responsible for collecting remitting and filing sales tax on all of your ridesharing trips.

Your federal tax rate may range from 10 to 37 and your state tax rate can range from 0 to. Select your preferred language. Agencies Uber Eats partnered with Leafly and will deliver marijuana to peoples doorsteps starting Monday in Canada.

The New Luxury Tax in Canada As of September of 2022 luxury cars boats and aircrafts may be subject a 10 to 20 new luxury tax in Canada depending on their price tag. In accordance with the rules and regulations outlined by the Canada Revenue Agency CRA Uber drivers Uber Eats Lyft. When you drive with Uber income tax is not deducted from the earnings you made throughout the year.

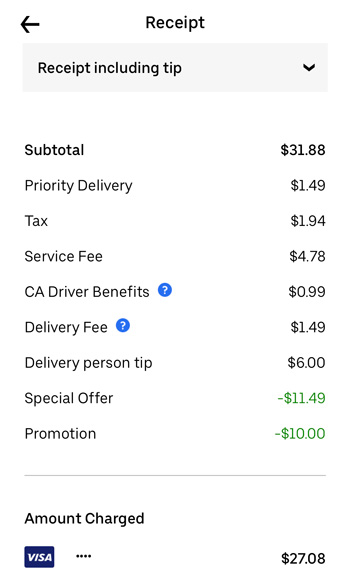

How Much Does Uber Eats Cost And Learn How To Save On Orders Ridesharing Driver

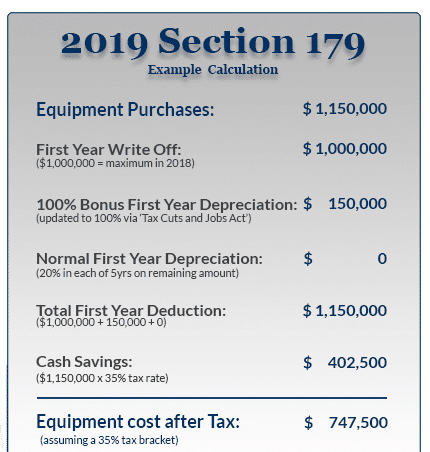

Standard Mileage Deduction Vs Section 179 For Rideshare Drivers

Filing Taxes For On Demand Food Delivery Drivers Turbotax Tax Tips Videos

Free Uber Tax Accounting Software Instabooks Us

How Do Food Delivery Couriers Pay Taxes Get It Back

Rideshare Tax Calculator A Simple Tax Calculator For Uber And Lyft Drivers Payments Taxes Income Uber Drivers Forum For Customer Service Tips Experience

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

2022 Income Tax Calculator Canada

How To Become An Uber Eats Delivery Driver

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

Here S Everything You Need To Know At Tax Time If You Don T Work A Traditional 9 To 5 Narcity

![]()

Income Tax Calculator 2022 Canada Salary After Tax

How Much Do Uber Eats Drivers Earn In Belgium Quora

Uber Eats Driver Pay Calculator For Canada And Usa

Uber Tax Information Essential Tax Forms Documents

Wayfair Aftershocks Persist With Marketplace Laws

2022 Uber Driver Tax Deductions See Uber Taxes Hurdlr

Amex Platinum Uber Credits How To Use For Rides And Uber Eats